Fagun Kutty

About

-

Posted Answers

Answer

The recent decision in Stephen May v HMRC UKFTT 32 (TC) deemed a grain silo structure to be apparatus and allowed capital allowances to be claimed accordingly. This timely ruling may well be welcome news to farmers looking to take advantage of this new limit.

For unincorporated businesses such as farming there is an opportunity to claim the AIA and offset against profits. Such a claim for AIAs often creates a tax loss, especially where farm profitability has been suffering. The problem with creating a tax loss with the AIA is the 25% cap of loss claims against total income.

The UK tax system recognises the farming taxpayer’s right to offset losses sustained in farming against what would otherwise be his taxable income, so as to extinguish or reduce the tax due on that income. The result of the aggregation of trading losses with income may be to “discharge” (ie cancel) tax liabilities due on that income, or to create repayment of income tax already paid. HMRC does not allow the tax relief on losses without question, and evidence and documentation where there are concerns is required. Original business plans to show the business would and could make money and how this would be achieved is essential.

Under the provisions of Finance Act (FA) 2013, legislation was introduced with effect from 6 April 2013 to apply a cap on income tax reliefs claimed by individuals. The cap applies to anyone seeking to claim more than £50,000 tax loss reliefs with the cap at 25% of income, or £50,000 if greater. The following reliefs are restricted:

The maximum amount the farmer will be able to claim in one tax year where the AIA creates a loss will be the greater of £50,000 and 25% of their income. Income is defined, in this instance, as their total income liable to tax, adjusted to include a deduction for the individual’s charitable donations through a payroll giving scheme, and to also exclude pension contributions, to give an adjusted total income. Thus, a farmer with an adjusted total income of £400,000 will only be able to offset a tax loss claim up to £100,000 (25% of £400,000), leaving £300,000 (£400,000–£100,000) still subject to Income Tax.

Interestingly the 25% cap on losses to be offset does not apply to the offset against a Capital Gains Tax (CGT) liability. For example, an Income Tax loss when set against a capital gain does not have to be restricted. Until FA 1991, farming losses were not able to be offset against CGT liability. This rule seriously affected the ability of farmers to sell surplus assets so as to raise cash to reduce their bank borrowings. Relief was enacted in s72 FA 1991, when the stated purpose was to bring unincorporated businesses into line with companies, which could already set trading losses against both income and their capital gains. This form of tax loss relief is now found in ITA 2007 s71.

It is only the trading losses of the year of sale which create the gain, or the year preceding the year of sale which creates the gain, which are available to offset against the gain. Any trading loss which is not set against income or gains of the current or succeeding year are available to be carried forward and set against future trading profits.

Another element of the 2018 Budget (now Finance Act 2018) that has seemed negative for “buy to let” property is the loss of “lettings relief”. This relief currently exempts from CGT gains accruing in a period when the main residence is let out up to a maximum of £40,000. This relief will now be restricted to apply only to periods where the owner jointly occupies the property. Together with the loss of the “buy to let” interest, there are now incentives to sell let property.

A strong tax-planning opportunity could be for a farmer to spend the maximum amount on AIA they can budget for, create a tax loss and then use this to offset against sales of non-business residences, saving tax at a rate of 28%. This also has the additional tax advantage of reducing investments that may not qualify for IHT relief. For example, “buy to lets” are unlikely to qualify, even under Balfour - Commissioners for HMRC v AM Brander (as executor of the Will of the late 4th Earl of Balfour) UKUT 300 (TCC), or they may tip the balance more in line with an investing business rather than a trading one. As such, removing assets like these with the increasing number of tax disadvantages is certainly worth some thought. Whilst saving tax at 28% CGT on residential property is not as high as the Income Tax rate for additional rate taxpayers at 45%, it still warrants a very balanced tax consideration.

Answer is posted for the following question.

Answer

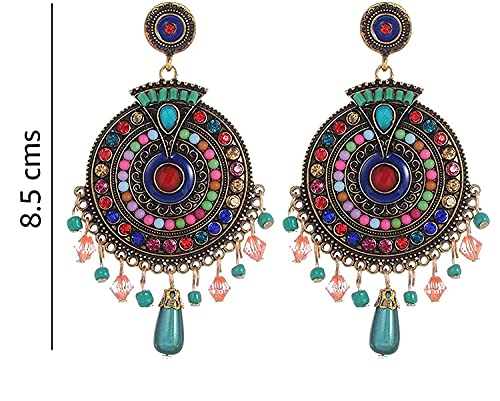

Purchased Price: Rs 245 INR from Amazon India

REVIEW

If you try to change the pin on the earring it will break.The arrangement of the beads is different on the earrings.The packing was not good at all.

Answer is posted for the following question.

Review this product YouBella Jewellery Bohemian Multi-Color Earrings for Girls and Women [Review]?

Answer

1 Use vitamin C serums in the morning There's certainly no law against using vitamin C products in the evening, but you may get the most

Answer is posted for the following question.

How long to leave vitamin c serum on face?

Answer

Amarillo , city, seat (1887) of Potter county (and partly in Randall county), with the Amarillo Art Center on its campus, was founded in 1929

Answer is posted for the following question.

When was amarillo founded?

Answer

This facility became the world's largest private office building By 1993, USAA 's owned and managed assets had reached $33 billion,

Answer is posted for the following question.

Is usaa privately owned?